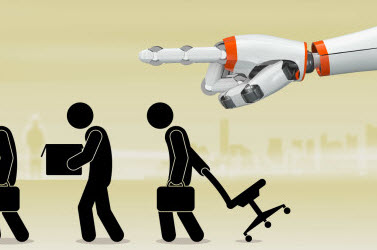

Seems that upwards of 50% of jobs around the world will be replaced by robotics and automation over the coming decades.

Crude inventories are rising as is the price of oil. What is going on?

We take a look at the concern over sanctuary cities, market internals, world economics and more.

Podcast: Play in new window | Download (Duration: 1:04:10 — 44.3MB)

Subscribe: RSS