A new crisis is brewing – banking sector again

Markets is sideways mode

The scary tariffs and a walk back

Apple News……..

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

We’re dedicating this episode to Sophia Maria — someone very special who left us too soon...

Warm-Up

- A new crisis is brewing - banking sector again

- Markets is sideways mode

- The scary tariffs and a walk back

- Apple News........

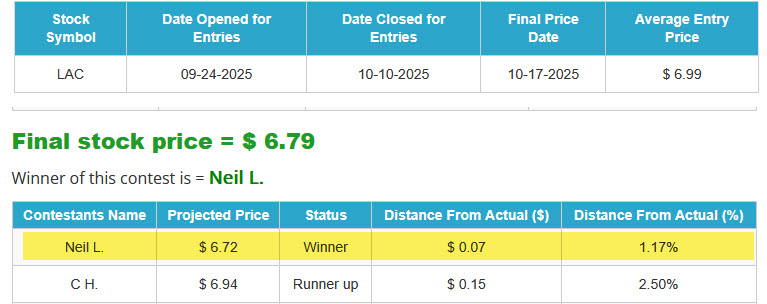

- Announcing the WINNER of the CTP for LAC

Markets

- Yields dropping

- Region bank scare due to 2/3 bankruptcies (new stress)

- Fed stops tightening - why is that?

- TACO trade is back

- Buig Tech earnings on the way

"Just when you think that the coast is clear - the banks will somehow screw things up"

US Government Shutdown - Day 19?

Bitcoin

- Hits all-time high above $125,000 - then pulls back

- Big moves with crypto last couple of weeks

- Trump tariff comments spooked speculators

-- Some coins were down 15-25% after the close on that Friday

GOLDDDDDDDDDDDDDDDDDDDDDD!

- Taking a walloping last couple of days...

-- Was really overbought

-- Silver getting hammered too (8% in 2 days)

Gold, Silver BOOM

- Also hits new highs - then backs off a tad

- Major holiday in India

--- First day of Diwali in India

- Buying gold (and silver) on Dhanteras is considered highly auspicious. It symbolizes:

-- Wealth and prosperity, invoking blessings from Goddess Lakshmi (the deity of wealth).

-- Health and longevity, honoring Lord Dhanvantari, the divine healer who is believed to have emerged with the nectar of immortality on this day.

-- Financial stability, as gold is seen as a secure and pure investment.

New Phrase

- Like the use of TAM - Total Addressable Market or other PR phrases....

- "Right to win" is a business strategy concept that refers to a company's ability to enter a competitive market with a high probability of success, based on its unique advantages. It is not an automatic entitlement but is earned through a coherent strategy that aligns a company's "way to play" (its strategy) with its core capabilities and assets. This requires a clear, sustainable competitive advantage over rivals

- Heard this just today TWICE - CEO of NASDAQ and CEO of Goldman Sachs

- OBNOXIOUS!

Super TACO

- What was that?

- Bad lunch or something?

- 100% tariff on China - on a Friday afternoon

- - Vance walks-back on Saturday - Just a negotiating tactic (so dumb)

- Trump Walks back on Sunday

Warnings

- David Solomon (GS CEO)

- Speaking at Italian Tech Week in Turin, Italy, he said a “drawdown” was likely to hit stock markets in the coming two years.

- Relating to the dot.com bubble: “You’re going to see a similar phenomenon here,” he said. “I wouldn’t be surprised if in the next 12 to 24 months, we see a drawdown with respect to equity markets ... I think that there will be a lot of capital that’s deployed that will turn out to not deliver returns, and when that happens, people won’t feel good.”

More Warnings

- Jamie Dimon talks about cockroaches related to the recent bankruptcies (where there is one - there are more...)

- First Brands Group, an auto parts supplier, filed for bankruptcy with over $11.6 billion in liabilities. The company’s use of invoice factoring—allegedly pledging the same receivables to multiple lenders—has triggered a federal investigation and raised alarms about off-balance-sheet financing.

- Tricolor Holdings, a subprime auto lender, is accused of fraudulently pledging risky loan portfolios to multiple banks. The fallout has led to significant write-downs at institutions like JPMorgan and Fifth Third Bancorp.

-- The regional banks under pressure as this is developing. Seems as though there is some concern that poor underwriting and sloppy loan issuance (and oversight) is something again.

------- This is much more difficult to paper over or to rescue like the Bond valuation crisis a couple of years ago.

ZERO Dated Options

- Daily turnarounds, especially on Fridays

- New studies showing that the zero date options push toward the end of the day is a big player

- On a index with 35-40% of top 10 holdings in makeup - easier to push those names and then collect on the options..

- Friday 10/17 is a good example of hos that occurs..

--- Decliners outpaced advancers all day - Small cap down - mega cap up

----- As day progressed, squeezing continued - (partially due to Trumps comments that everything is going well with China - aka 180 degrees from the Friday before)

Listener Question:

- What is the Mar-a-Lago Accord?

- The phrase “Mar-a-Lago Accord” was coined by US money market wizard and previous Credit Suisse Strategist Zoltan Poszar back in June 2024 on an idea that the US could force countries to accept a weaker dollar and lower interest rates on their US Treasury investments in order to still be protected by the US security ...

GM Earnings

- GM stock rose more than 15% in trading Tuesday. The stock, which closed Monday at $58 per share, had its best day since 2020 and its second best day on the market since its 2009 emergence from bankruptcy.

- Here’s how the company performed in the third quarter, compared with average estimates compiled by LSEG:

-- Earnings per share: $2.80 adjusted vs. $2.31 expected

-- Revenue: $48.59 billion vs. $45.27 billion expected

-- Adjusted EBIT: $3.38 billion vs. $2.72 billion expected

- GM also reduced the expected impact of tariffs this year to between $3.5 billion and $4.5 billion, down from $4 billion to $5 billion. The automaker expects to offset about 35% of that impact.

Meanwhile - Ferrari

- Ferrari posted their worst trading day ever on last Thursday after the luxury carmaker updated its full-year and 2030 guidance and scaled back its electrification ambitions.

- Analysts were disappointed by the new guidance, saying it fell short of expectations.

- The Italy-based sports car manufacturer said at its Capital Markets Day, or CMD, event that it expected net revenue of at least 7.1 billion euros ($8.2 billion) this year, up from a previous forecast of more than 7 billion euros.

- Net revenue is expected to be around 9 billion euros in 2030, and the company is targeting earnings before interest, taxes, depreciation and amortization, or EBITDA, of at least 3.6 billion euros by 2030.

Quantum Stocks

- JP Morgan announced that it will invest $10B in 27 specific industries, including Quantum computing - that sent them flying again

- RGTI, IONQ, QBTS - to the moon!

Apple News

- Apple and Formula 1 today announced a five-year partnership that will bring all F1 races exclusively to Apple TV in the United States beginning next year.

- The partnership builds on Apple’s deepening relationship with Formula 1 following the global success of Apple Original Films’ adrenaline-fueled blockbuster F1 The Movie, the highest-grossing sports movie of all time.

- United by a commitment to innovation and fan experience, the partnership sets the stage for Formula 1’s continued growth in the U.S.

More Apple News

- iPhone 17 series outperformed its predecessor in early sales in China and the United States, research firm Counterpoint said on Monday.

- The newer models outsold the iPhone 16 series by 14% during their first 10 days of availability in the two countries, Counterpoint said in a report.

- Sales of the base model iPhone 17 nearly doubled in China compared to the iPhone 16 during the same period, it added, with sales of the model rising 31% across the two markets.

- Stock hits ATH on Monday and helps DJIA move up BIG

Pharma Follw Up

- Several pharmaceutical companies have said they will sell drugs direct to patients in the U.S. and offered discounts following President Donald Trump's calls to bring down drug prices and cut out "middlemen" like pharmacies, insurers and pharmacy benefit managers.

- This is another blow to pharmacies

Robbery!

- Thieves in balaclavas broke into Paris' Louvre museum on Sunday, using a crane to smash an upstairs window, then stealing priceless objects from an area that houses the French crown jewels before escaping on motorbikes, officials said.

The robbery raises awkward questions about security at the museum, where officials had already sounded the alarm about lack of investment at a world-famous site

- They said it was likely the robbery was either commissioned by a collector, in which case there was a chance of recovering the pieces in a good state, or undertaken by thieves interested only in the valuable jewels and precious metals.

Blame Game

- Companies across the U.S. and Europe have been cutting staff, citing the impact of artificial intelligence.

There may be more to the layoffs than meets the eye as firms are "scapegoating" the technology to take the fall for challenging business moves such as layoffs, according to one professor.

Some companies that flourished during the pandemic "significantly overhired" and the recent layoffs might just be a "market clearance," the professor said.

Is this the new normal?

- The Dutch government has invoked control of Nexperia, a Chinese-owned semiconductor maker based in the Netherlands, under its Goods Availability Act.

- Following the announcement by The Hague, Wingtech’s Shanghai-listed shares plunged 10% to hit its max daily limit.

- The Dutch government has taken control of Nexperia, a Chinese-owned semiconductor maker based in the Netherlands, in an extraordinary move to ensure a sufficient supply of its chips remains available in Europe amid rising global trade tensions.

- Nexperia, a subsidiary of China’s Wingtech Technology, specializes in the high-volume production of chips used in automotive, consumer electronics and other industries, making it vital for maintaining Europe’s technological supply chains.

Boooooze

- Exports of U.S. spirits fell 9% in the second quarter, according to a report by the Distilled Spirits Council of the United States published on Monday, which warned that trade tensions were hitting demand in key markets.

- The decline marked a sharp reversal from 2024's strong export performance, with steep drops across major markets including the European Union, Canada, Britain and Japan, which together represent 70% of total exports by value

- Canada saw the most dramatic fall, with U.S. spirits exports plummeting 85% to below $10 million in the second quarter. The majority of Canadian provinces continue to ban American spirits from their shelves in response to U.S. tariffs targeting -

- Exports to the EU, the industry's largest market, dropped 12% to $290.3 million, while shipments to Britain fell 29% to $26.9 million and those to Japan decreased 23% to $21.4 million, with DISCUS also citing trade tensions.

OpenAI

- Following up on the vendor financing and circular financing

- OpenAI has close to a TRILLION DOLLARS of commitenets over the next 10 years.

- Signed a deal with AMD last we spoke and spiked that stock 40% (OpenAI could option for 10% ownership through warrants)

- As part of the arrangement, AMD issued a warrant that gives OpenAI the ability to buy up to 160 million shares of AMD for 1 cent each over the course of the chip deal. The warrant vests in tranches based on milestones that the two companies have agreed on.

MORE....

- Questions starting to get raised about the possibility of OpenAI actually being able to fund these deals.

- Example - Oracle reprising - DOWN 18%

Love the Show? Then how about a Donation?

The Closest to The Pin for

Lithium Americas (LAC)

Winners will be getting great stuff like the new "OFFICIAL" DHUnplugged Shirt!

FED AND CRYPTO LIMERICKS

See this week’s stock picks HERE

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Podcast: Play in new window | Download (Duration: 1:05:32 — 60.3MB)

Subscribe: RSS