Earnings season – better and stats

– BIGGEST BUYBACK EVER

– We are gauging investor sentiment

— Remember – Confidence and Sentiment (Cheer-leading helps)

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- Earnings season - better and stats

- BIGGEST BUYBACK EVER

- We are gauging investor sentiment --

--- Remember - Confidence and Sentiment (Cheer-leading helps)

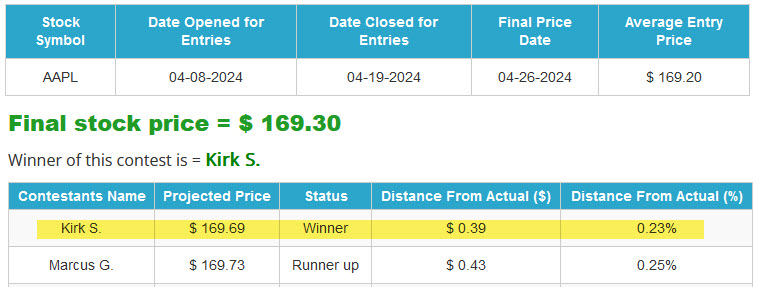

- Announcing the WINNER CTP for Apple

- Fake Work?

Market Update

- If down - buy.... Names that were hammered due to earnings catching bids again

- Follow up - Utilities

- Fed Speaks - Can't stop the Dove

- Employment - Excitement about the Unemployment Rate

Earnings Season Update:

- Overall, 80% of the companies in the S&P 500 have reported actual results for Q1 2024 to date.

- Of these companies, 77% have reported actual EPS above estimates, which is equal to the 5-year average of 77% but above the 10-year average of 74%.

- In aggregate, companies are reporting earnings that are 7.5% above estimates, which is also below the 5-year average of 8.5% but above the 10-year average of 6.7%

- Eight of the eleven sectors are reporting year-over-year earnings growth, led by the Communication Services, Utilities, Consumer Discretionary, and Information Technology sectors.

- Three sectors are reporting a year-over-year decline in earnings: Energy, Health Care, and Materials.

- Revenue - up again - estimated to be 4.1% when all said and done.

- - If 4.1% is the actual revenue growth rate for the quarter, it will mark the 14th consecutive quarter of revenue growth for the index.

Fake Work

- An investor at famed Silicon Valley firm Andreessen Horowitz is the latest VC to get involved in the debate around "fake work" in the tech industry.

- Ulevitch went on to point the finger at Google specifically, calling it "an amazing example."

- "I don't think it's crazy to believe that half the white-collar staff at Google probably does no real work," he said. "The company has spent billions and billions of dollars per year on projects that go nowhere for over a decade, and all that money could have been returned to shareholders who have retirement accounts."

- Marc Andreessen has criticized a managerial "laptop class" and tweeted in 2022, "The good big companies are overstaffed by 2x. The bad big companies are overstaffed by 4x or more."

Buy 'em

- Companies that took a hit after earnings (NFLX, AMD) getting bid again

- NFLX gapped lower from ~$608 to $551 and now $592

- AMD dropped from $160 to $140 and now $156

- SPY , IWM and QQQ- Now above the 50day Moving average again

Follow Up - Utilities

- Just wanted to provide this idea again - Data Warehouses and other AI Power hungry places

--- Symbol list of some utilities to look at further - SO, NEE, EXC, CMS

- Natural gas producers are planning for a significant spike in demand over the next decade, as artificial intelligence drives a surge in electricity consumption that renewables may struggle to meet alone.

- After a decade of flat power growth in the U.S., electricity demand is forecast to grow as much as 20% by 2030, according to a Wells Fargo analysis published in April. Power companies are moving to quickly secure energy as the rise of AI coincides with the expansion of domestic semiconductor and battery manufacturing as well as the electrification of the nation's vehicle fleet.

- AI data centers alone are expected to add about 323 terawatt hours of electricity demand in the U.S. by 2030

Apple - Earnings

- Nothing great in the earnings.

--- A few pockets of sunshine....

--- Raises dividend and $110 BILLION buyback - largest buyback EVER for ANY company

---- Berkshire cut stake by 13% (Not sure if is simply reducing position after massive growth or other decision)

SAVE SAVE

- Earnings not paining a pretty picture

- Blaming on issues with Pratt & Whitney due to manufacturing issues with Geared TurboFan engines

- Outlook by management was less than expected

- - Company planing on providing strategic updates in the next couple of months - But struggling..

----- Makes no sense that the JetBlue deal was blocked...

Yuck

- Beyond Meat announces another Beyond Meat product will be available at Whole Foods Market stores nationwide with the addition of the smash-style Beyond Stack Burger

-- Does that sound good?

Sentiment

- The Schwab Trading Activity Index (STAX) decreased to 48.87 in April, down from its score of 51.65 in March

- The reading for the four-week period ending April 26, 2024, ranks "moderate low" compared to historic averages as investment exposure decreased. U.S. equity markets fell during the April STAX period and indices experienced several single-day losses of greater than 2% following disappointing economic data releases.

- Popular names bought by Schwab clients during the period included: NVIDIA Corp. (NVDA) Advanced Micro Devices Inc. (AMD) Super Micro Computer Inc. (SMCI) Amazon.com Inc. (AMZN) Microsoft Corp. (MSFT)

- Names net sold by Schwab clients during the period included: Walt Disney Co. (DIS) PayPal Holdings Inc. (PYPL) Exxon Mobil Corp. (XOM) Devon Energy Corp. (DVN) Occidental Petroleum Corp. (OXY)

Buyers Buying

- Hon Hai Precision (AKA FoxConn) The company, which assembles the majority of Apple Inc.’s smartphones, reported a 19% rise in monthly sales to NT$510.9 billion ($15.8 billion), compared with revenue of NT$429.2 billion in April 2023.

- The company said in a statement Sunday that April revenue climbed to a record for the month.

- This report raises expectations for iPhone sales while AI-related business booms. (although does not actually line up with Apple's earnings call)

On The Other Hand

- South Korea's factory output fell in March by the most in 15 months, government data showed on Tuesday, missing market expectations.

- The industrial production index fell 3.2% from a month earlier on a seasonally adjusted basis, after a gain of 2.9% in February and compared with a rise of 0.6% tipped in a Reuters survey of economists.

- It was the fastest monthly fall since December 2022 and caused by declines in metal processing and electronic parts, according to Statistics Korea.

Carvana

- The father-son duo behind Carvana Co. have seen their fortunes rebound as shares of the Phoenix-based online used-car dealer have surged more than 3,000% from historic lows.

- Ernie Garcia II and Ernie Garcia III have added more than $11 billion in combined net worth since December 2022, when Carvana stock fell below $4 a share as rising interest rates sapped sales and the company was forced to restructure debt.

- Carvana shares jumped 34% on Thursday to the highest in more than two years after the company reported stronger first-quarter earnings with revenue topping analysts’ expectations.

Savings - Gone

- US households have exhausted the pile of cash squirreled away during the pandemic

The latest estimates of overall pandemic excess savings remaining in the US economy have turned negative, suggesting that American households fully spent their pandemic-era savings as of March 2024,” (San Francisco Fed economists)

AND - Social Security

- According to SS Trustees: The trust funds the Social Security Administration relies on to pay benefits are now projected to run out in 2035, one year later than previously projected

- The Social Security trustees credited the slightly improved outlook to more people contributing to the program amid a strong economy, low unemployment and higher job and wage growth.

AI Reality

- ServiceNow Inc.’s new generative AI-focused product tier will take time to boost financial results, executives said, sending a lukewarm message to investors looking for big impact from the highly hyped technology.

- “While it might take some time to have a material impact to the top line, the opportunity is massive

Love the Show? Then how about a Donation?

ANNOUNCING THE WINNER

CTP FOR APPLE

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Podcast: Play in new window | Download (Duration: 1:05:28 — 60.2MB)

Subscribe: RSS