SUPERBOWL Mania.

Bitcoin Fever is back

HUGE week for economic reports

Altman looking for $

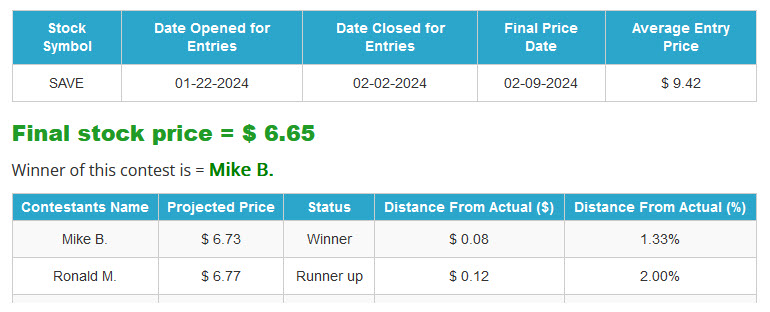

Winner for SAVE CTP announced

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- SUPERBOWL Mania

- Bitcoin Fever is back

- HUGE week for economic reports

- Altman looking for $

- Winner for SAVE CTP

Market Update

- 3-Day Rule (Buy after plunge) - Made up Nonsense

- Get out your 5,000 Hats!

- Disney Earnings - Good Stuff

- ARM Blowout

- CPI Report Meltdown

S&P 500 Breaks 5,000!

- All time high

- The S&P 500 continues to hit fresh milestones with a first-ever break above the 5,000 level, its valuation is reaching new heights as well.

- PE - forward price-to-earnings ratio -- a commonly used metric to value stocks -- this week rose to 20.4 times, a level last reached in February 2022, according to LSEG Datastream.

- That puts it far above the index’s historic average of 15.7.

- Expectations are for 9.7% earnings growth for 2024

- "The good news is that valuations, while stretched ... are nowhere near the 28x peak at the Y2K Bubble Top," Emanuel said. ????

Follow Up----

- CPI came out HOT!

- YoY 3.1% for CPU and 3.9% for Core

- The food index was up 0.4% month-over-month and up 2.6% year-over-year.

- The energy index was down 0.9% month-over-month and down 4.6% year-over-year.

- The used cars and trucks index decreased 3.4% month-over-month and was down 3.5% year-over-year.

- The shelter index was up 0.6% month-over-month and up 6.0% year-over-year.

- The all items index less shelter was up 1.5% year-over-year.

----- Markets hit after reports - gained a bit back toward end of the session - but overbought and hot CPI don't mix

--- Small Caps down 4%, NAZ down 2% S&P down 1.4%

What Does it Mean?

- Fed funds futures push any cut until June

- 4 cuts are expectations for 2024 (down 7 at the start of the year)

Economics this week

NVDA

- Up, Up, UP

- Goldman Target = $800

- NVIDIA surpassed Amazon (AMZN) in market value for a brief period on Monday

More NVDA

- Company is building a new business unit focused on designing bespoke chips for cloud computing firms and others, including advanced artificial intelligence (AI) processors, nine sources familiar with its plans told Reuters.

- The dominant global designer and supplier of AI chips aims to capture a portion of an exploding market for custom AI chips and shield itself from the growing number of companies pursuing alternatives to its products.

Altman (ChatGPT)

- OpenAI CEO Sam Altman is seeking trillions of dollars in investments to overhaul the global semiconductor industry

- Altman has long talked of the supply and demand problem with AI chips

- He's considering a project that would increase global chip-building capacity,

- Altman could need to raise between $5 trillion and $7 trillion for the endeavor

- Reportedly in talks with different investors, including the government of the United Arab Emirates.

Waymo Cars Attacked

- On Saturday night, a crowd surrounded a white sport utility vehicle that was moving along a street in the city's Chinatown district (San Fran)

- A person jumped onto the hood of the Waymo vehicle and broke its windshield. Another person also jumped on the hood 30 seconds later as some in the crowd clapped in approval

- Fireworks thrown in car and set on fire.

- On previous occasions in San Francisco and Phoenix, Arizona, groups have disrupted the operations of self-driving vehicles, blocking their path, trying to enter the vehicles and jumping on their hoods

Amazon

- Bezos unloading shares

- $2 billion last week

- Plans to sell 50 million shares over the next year or so

Israel

- Downgraded by Moody's

-- That took a while

- Israel received its first-ever sovereign downgrade as Moody’s Investors Service lowered its credit rating, citing the impact of the ongoing military conflict with Hamas on its finances.

- Moody's cited material political and fiscal risks from the war, adding "Israel's budget deficit will be significantly larger than expected before the conflict."

- Israel stock market up 40% from WAR lows - now near levels from Jan 2023

Disney

- Magical Earnings

- Walt Disney Co. shares rose as much as 10.5%, the biggest intraday gain since Dec. 2020, after reporting better-than-expected earnings for its fiscal first quarter.

- The entertainment giant issued an upbeat profit outlook for the year, giving Chief Executive Officer Bob Iger ammunition to deflect proxy challenges at its shareholder meeting this spring.

- Shorts- were smoked - still wondering if this is sustainable

Cathie Wood - Lost How Much?

- The much-hyped investment firm Ark Invest, led by Cathie Wood, has reportedly seen a massive erosion of wealth over the past ten years, amounting to a staggering $14.3 billion.

- According to a recent Morningstar analysis, the wealth destruction at Ark Invest, a company that gained widespread attention for its high-risk tech investments, has been attributed to the 2022 bear market.

- Despite the significant losses, Ark Invest still manages over $13 billion in assets across its ETFs, indicating that some investors continue to believe in Wood’s investment strategy.

China

- DEFLATION

- China's consumer prices fell at their steepest pace in more than 14 years in January

- The annual CPI decline in January was the biggest since September 2009, mainly led by a sharp drop in food prices

- Analysts warn the overall deflationary impulse in the economy risks becoming entrenched in consumer behaviour.

Inflation Expectations - US (Survey)

- NY Fed says one-year expected inflation unchanged at 3%

- Median inflation expectations remained unchanged at the one- and five-year ahead horizons in January, at 3.0% and 2.5%, respectively.

- Median inflation expectations at the three-year ahead horizon declined to 2.4% from 2.6%.

- Median year-ahead expected price changes declined for all goods tracked in the survey, falling by 0.3 percentage point for gas to 4.2%, by 0.1 percentage point for food to 4.9%, by 0.9 percentage point for rent to 6.4%, by 0.5 percentage point for medical care to 8.6%, and by 0.4 percentage point for the cost of a college education to 5.9%.

ARM Holdings Stock

- Massive earnings blowout - AI chip development helped the company

- Stock up HUGE

- Softbank big owner of this one - made up for all of the WeWork losses

- Shares were at $70 pre earnings, then went to $94 and traded north of $160 on Monday

- 120% in 5 days

New SEC Rules

- US regulators will begin requiring hedge funds to confidentially share more information about their investment strategies.

- New rules approved on Thursday will require firms to provide more details to watchdogs, including on investments, borrowing and counter-party exposure. The Securities and Exchange Commission and Commodity Futures Trading Commission described the new regulations, which were proposed in 2022, as a way to better keep

Love the Show? Then how about a Donation?

CTP for Spirit Airlines

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Podcast: Play in new window | Download (Duration: 1:00:35 — 55.8MB)

Subscribe: RSS